Asia’s Evolving ESG Disclosure Rules: Latest Updates

This blog was originally posted on 25th March, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

While the EU remains the frontrunner in driving greater transparency and accountability in corporate sustainability reporting, Compliance & Risks is seeing a definite maturation of Asian regulations in this space. Asia is rapidly advancing ESG disclosure rules and, despite some international alignment, companies should be prepared to face diverse ESG reporting rules in this region.

Compared with the EU, a more tailored, risk-based approach is becoming evident – the standardized reporting system at the heart of EU action can be contrasted with the developing individual systems in Asia.

As we approach the end of Q1 2025, Compliance & Risks has rounded up the latest critical updates regarding the sustainability reporting regulatory landscape in Asia.

China

China has made progress on its own ESG standards with a focus on its specific national priorities, such as its carbon neutrality goals.

Early in 2024 China’s three stock exchanges issued ESG reporting guidelines, mandating companies of the SSE 180 Index, STAR 50 Index, SZSE 100 Index, ChiNext Index and companies listed domestically and overseas to disclose their ESG metrics in 2026.

The China Securities Regulatory Commission (CSRC) is urging other companies not listed above to voluntarily publish ESG reports.

In December, the Ministry of Finance (MOF) finalized the Basic Guidelines for Corporate Sustainability Disclosure. This follows the International Sustainability Standards Board (ISSB)’s disclosure framework, which requires companies to disclose information related to governance, strategy, risk and opportunity management, as well as indicators and targets. MOF’s guidelines follow the principle of double materiality, which assesses ESG impacts on a firm’s financials and on ESG outcomes. This is considered to be a crucial move towards fostering a disclosure environment in China because it marks the beginning of MOF’s plan to issue both the general standard for corporate sustainability disclosure (based on IFRS S1) and the climate-related disclosure standard (based on IFRS S2) by 2027, laying the foundation for building a national sustainability disclosure system by 2030.

Hong Kong

Hong Kong has recently moved to standardize and enhance sustainability reporting, through the publication of HKFRS Sustainability Disclosure Standards (‘HKFRS SDS’). The mandatory application of HKFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information and HKFRS S2 Climate-Related Disclosures (‘HKFRS SDS’) will be progressively implemented, with large publicly accountable entities targeted for full adoption by 2028. In the interim, the application of HKFRS SDS will be voluntary.

The HKFRS SDS are fully aligned with the IFRS Sustainability Disclosure Standards (ISSB Standards).

Meanwhile, companies listed on the Hong Kong Stock Exchange (HKEX) are being required, starting 1 January 2025, to disclose Scope 1 and 2 GHG emissions, by what is known as the ‘New Climate Requirements’, aligned with IFRS S2 (Climate-related Disclosures).

Japan

Japan has just released its first sustainability disclosure standards, the “SSBJ Standards”. While initially these standards will be optional, all companies on Tokyo’s Stock Exchange Prime List are on notice of the issuance of potential future mandates.

The SSBJ Standards are equivalent to the IFRS Sustainability Disclosure Standards (IFRS S1 and IFRS S2) issued by the ISSB. The SSBJ has however divided IFRS S1 into two distinct standards. Fundamental requirements for preparing sustainability-related financial disclosures are contained in a ‘universal standard’ known as the Application Standard. Japan’s equivalent of IFRS S1 incorporates the section covering the disclosure of sustainability-related risks and opportunities (referred to as ‘core content’).

Companies eager to implement ahead of the mandate can apply the 3 standards for annual reporting periods that end on or after 5 March 2025.

Singapore

Recent significant reform means that from the financial year (FY) 2025, all listed companies in Singapore will be required to make mandatory climate-related disclosures, specifically regarding scope 1 and scope 2 greenhouse gas emissions. This aligns with the standards set by the International Sustainability Standards Board (ISSB).

From FY2027, large non-listed companies (‘NLCos’ – those with annual revenue of at least $1 billion and total assets of at least $500 million) will be required to do the same.

From FY2027, external limited assurance on Scope 1 and 2 greenhouse gas emissions will be required, which should strengthen the credibility and reliability of reported data. For NLCos, the deadline is FY2029.

South Korea

On 30 December 2024, the Korean Financial Services Commission (FSC) indicated in a press release that the final versions of the Korean Sustainability Disclosure Standards (KSDS), alongside a roadmap for implementation, will be published in the first half of 2025. These are expected to comprise two mandatory disclosure standards (KSSB 1 and KSSB 2) and one non-mandatory disclosure standard (KSSB 101), a country-specific standard that will enable companies to optionally disclose additional sustainability-related information.

At the date of writing, Compliance & Risks can confirm that no finalized standards have yet been published.

Vietnam

The latest news on ESG disclosure rules in Vietnam comes from 4 October 2024, when a Handbook on Environmental, Social, and Governance (ESG) Implementation and Disclosure was officially launched for the Vietnamese business community. This handbook provides guidelines and reference materials to help businesses integrate ESG into their governance, strategy and operations.

In Vietnam, ESG disclosures for certain listed companies are governed by Circular No. 96/2020/TT-BTC.

Although Vietnam currently follows Vietnam Accounting Standards, and not IFRS, the Ministry of Finance has laid out plans to transition from Vietnamese Accounting Standards (VAS) to IFRS in 2025, aligning its reporting practices with international norms.

Insofar as IFRS S1 and IFRS S2 are concerned, there is no indication yet that these will be applied when IFRS is adopted.

Stay Ahead Of Regulatory Change in ESG Disclosure Rules

Want to stay ahead of ESG disclosure rules and other ESG regulatory developments?

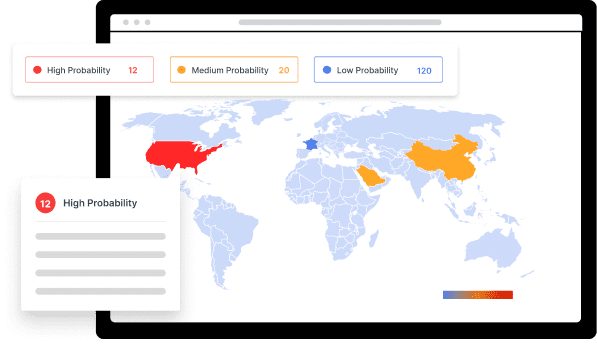

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network