ESG Regulatory Developments in July 2024

This blog was originally posted on 12th August, 2024. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY JOANNE O’DONNELL, HEAD OF GLOBAL REGULATORY COMPLIANCE TEAM, COMPLIANCE & RISKS

July was a busy month in the ESG world. Here is a summary of some key ESG regulatory developments:

EU Publishes FAQ Document on Corporate Sustainability Due Diligence Directive (CSDDD)

The Corporate Sustainability Due Diligence Directive (CSDDD) entered into force on 25 July 2024. On the same day, the EU also released a Frequently Asked Questions document to accompany the Directive.

The FAQ document is divided into the following sections:

- General Overview

- Objectives

- Entry into Force/Application

- Personal Scope

- Material Scope

- Content of Obligations

- Enforcement

- Burden Limitation and Safeguards

- Impacts of the Directive

Germany Announces Plans to Amend its Due Diligence in Supply Chain Act

At the beginning of July, the German government announced plans to amend the Due Diligence in Supply Chains Act within the current legislative session, which ends in autumn 2025.

In its budgetary announcement, the government announced its intention to fully align the German Act with the EU Corporate Sustainability Due Diligence Directive (CSDDD) which entered into force on 25 July. The CSDDD requires EU member states to introduce supply chain due diligence requirements for companies with more than 5,000 employees worldwide and a turnover of 1,500 million euros from 2027; for companies with more than 3,000 employees worldwide and a turnover of 900 million euros from 2028; and for companies with more than 1,000 employees worldwide and a turnover of 450 million euros from 2029.

The German Due Diligence in Supply Chain Acts on the other hand entered into force on 1 January 2023 and is applicable to companies with at least 1000 employees since 1 January 2024. The announced amendment would now mean that the thresholds in the German act would be aligned with the European thresholds, and all obligations arising from the CSDDD, including the provisions on civil liability, will only become binding at the latest date prescribed by European law.

Updates to US Strategy to Prevent the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in China

On 9 July, the Department of Homeland Security (DHS) published an update to the Strategy to Prevent the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in China.

The Strategy was first released on 17 June 2022 and provides information about U.S. Customs and Border Protection’s enforcement of the Uyghur Forced Labor Prevention Act’s (UFPLA) rebuttable presumption that any goods, wares, articles, or merchandise mined, produced, or manufactured wholly or in part in the Xinjiang Uyghur Autonomous Region (Xinjiang) of the PRC, or produced by an entity on the UFLPA Entity List, are prohibited from entering the United States.

The newly published 2024 edition of the Strategy include additions to the following sections:

- Evaluation and Description of Forced-Labor Schemes and UFLPA Entity List

- Additional Resources Necessary to Ensure No Goods Made with Forced Labor Enter at U.S. Ports

- Coordination and Collaboration with Appropriate Nongovernmental Organizations and Private-Sector Entities

Additionally, during this reporting period, the FLETF added an additional 38 entities to the Entity List bringing the total on that list to 68. The FLETF also added new high-priority sectors for enforcement, namely polyvinyl chloride, aluminum and seafood. These additions are based on a finding that these industries involve a higher risk of forced labor of Uyghurs as well as members of other persecuted groups from the XUAR. These new priority sectors enhance the listing of those sectors previously identified by the FLETF, i.e. apparel, cotton and cotton products, silica-based products (including polysilicon), and tomatoes and downstream products.

IASB Launched Consultation of Exposure Draft to Improve Reporting of Climate-related and Other Uncertainties in Financial Statements

On 31 July 2024, the International Accounting Standards Board (IASB) officially launched a consultation on the Exposure Draft Climate-related and Other Uncertainties in the Financial Statements.

The Exposure Draft proposes eight examples on how companies apply the IFRS Accounting Standards to report the effects of climate-related and other uncertainties in its financial statements.

The examples are intended to improve the way entities report the effect of climate-related and other uncertainties in their financial statements.

The Exposure Draft is subject to public consultation until 28 November 2024. At the end of the consultation period, IASB will consider the comments received and decide whether to proceed with the proposed illustrative examples.

The document and comment letter to submit feedback can be accessed on the IFRS Foundation’s website.

Stay Ahead Of ESG Regulatory Developments

Want to stay on top of ESG regulatory developments?

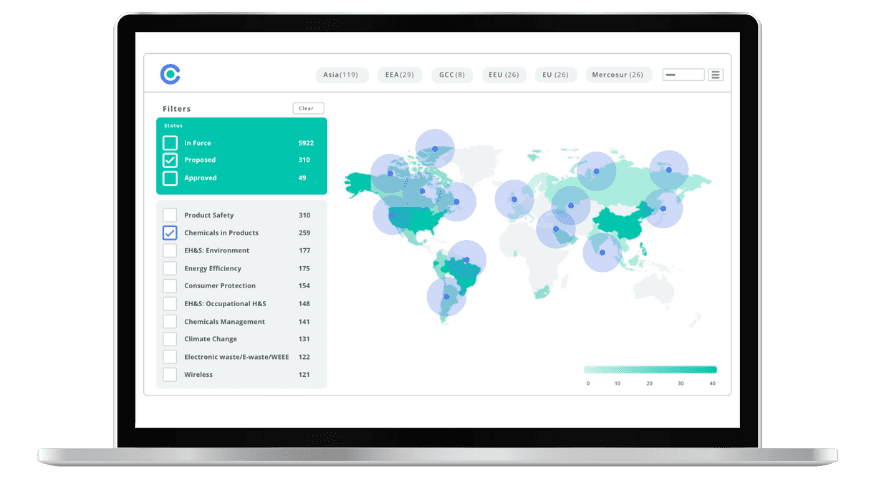

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – Your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

ESG 2023: A Year in Review

Our whitepaper summarizes the ESG regulatory landscape in 2023, reviewing the key regulations proposed, published and/or entered into force.