Japan’s First Sustainability Disclosure Standards: Introduction of the SSBJ Standards

This blog was originally posted on 12th March, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY YUKO YAMAMOTO, REGULATORY AND COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

On 5 March 2025, the Sustainability Standards Board of Japan (SSBJ) announced the release of Japan’s first sustainability disclosure standards, known as the “SSBJ Standards.”

These standards align with the International Sustainability Standards Board (ISSB) framework, which provides international standards for sustainability disclosures. The SSBJ Standards are essentially equivalent to the IFRS Sustainability Disclosure Standards (IFRS S1 and IFRS S2) issued by the ISSB.

Composition of the SSBJ Standards

The SSBJ Standards published include the following:

- Universal Sustainability Disclosure Standard – “Application of the Sustainability Disclosure Standards” (Application Standard)

- Theme-based Sustainability Disclosure Standard No. 1 – “General Disclosures” (General Standard)

- Theme-based Sustainability Disclosure Standard No. 2 – “Climate-related Disclosures” (Climate Standard)

While the IFRS standards are divided into IFRS S1 and S2, Japan’s corresponding standards are separated into three. This is because the Japanese version splits IFRS S1 into two distinct standards.

The portion of IFRS S1 that outlines the fundamental requirements for preparing sustainability-related financial disclosures has been established as a separate ‘universal standard,’ known as the Application Standard in Japan. Meanwhile, the section covering the disclosure of sustainability-related risks and opportunities (referred to as ‘core content’) has been incorporated into Japan’s equivalent of IFRS S1.

Key Sustainability Information Companies Shall Disclose

Under the SSBJ Standards, companies are required to disclose information covering the following four key elements:

- Governance: Information on the board of directors’ oversight structure and sustainability strategy.

- Strategy: Details on climate change risk assessment, business impacts, and adaptation strategies.

- Risk Management: Identification, assessment, and management methods of ESG risks.

- Indicators and Targets: GHG emission reduction targets (scope 1, 2, and 3) and other sustainability-related metrics.

Target Companies and Effective Date

While the SSBJ Standards do not explicitly specify the target companies, they were developed with the assumption that they will be applied by entities listed on the Prime Market of the Tokyo Stock Exchange.

Currently, the application of the SSBJ Standards is voluntary and can be applied for annual reporting periods ending on or after 5 March 2025. When applying, the Application Standard, General Standard, and Climate Standard shall all be implemented together.

Future Outlook

Although voluntary at present, the SSBJ Standards are expected to gradually become mandatory, starting with companies with larger market capitalizations. The proposed timeline for mandatory application is as follows:

- Fiscal year ending March 2027: Companies with a market capitalization of 3 trillion JPY or more

- Fiscal year ending March 2028: Companies with a market capitalization of 1 trillion JPY or more

- Fiscal year ending March 2029: Companies with a market capitalization of 500 billion JPY or more

- To be determined: Full application to all companies listed on the Tokyo Stock Exchange Prime List

The SSBJ Standards are currently available only in Japanese. However, an English overview is provided by the SSBJ here. Additionally, a schedule of differences and a concordance table between the ISSB Standards and SSBJ Standards are expected to be published in English soon.

Stay Ahead Of Regulatory Changes like Japan’s SSBJ Standards

Want to stay ahead of these regulatory developments?

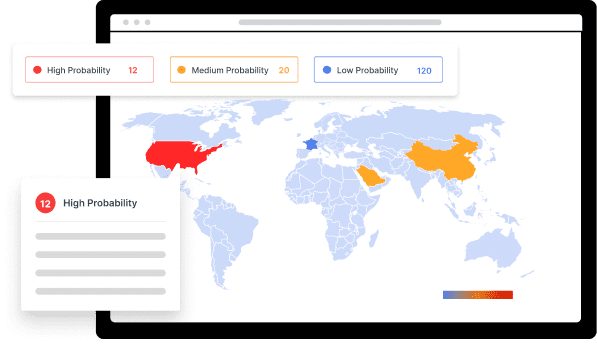

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Authors