Omnibus Package: Disrupting Europe’s Sustainability Landscape

This blog was originally posted on 4th March, 2025. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY HANNAH JANKNECHT, REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

The EU Commission published its highly anticipated ‘Simplification Package’ on 26 February 2025.

The package consists of ‘Omnibus I’, which proposes amendments to the:

- Corporate Sustainability Reporting Directive (CSRD);

- Corporate Sustainability Due Diligence Directive (CSDDD);

- Taxonomy Implementing Acts; and

- Carbon Border Adjustment Mechanism.

‘Omnibus II’ furthermore proposes to enhance InvestEU, a program aimed at boosting green investment and innovation in Europe. These enhancements include mobilizing approximately 50 billion Euros in additional public and private investment and streamlining the program’s administrative processes.

What are the Main Changes Proposed in Omnibus I?

As expected, Omnibus I goes beyond simply merging and streamlining the existing corporate reporting and due diligence requirements.

The package contains two separate proposals to amend the CSRD and CSDDD. The first proposal aims to ‘stop-the-clock’ by pushing out reporting obligations under the CSRD for those companies that have not yet started to report, but that are required to report as of 2026 or 2027 (wave 2 and wave 3 companies). This concerns large non-public companies with more than 500 employees, large public companies with less than 500 employees and listed SMEs.

The ‘stop-the-clock’ proposal seeks to avoid unnecessary expenses for these companies, as the Commission’s second proposal intends to remove them from CSRD reporting requirements altogether. In order to make this happen, the Commission is planning to ‘fast-track’ this proposal, even though the adoption process might still take several months.

Based on the first proposal, large companies with more than 3000 employees would furthermore be given one additional year to comply with the requirements of the CSDDD.

The second proposal contains significant changes to the corporate reporting and due diligence requirements under both directives.

1. Corporate Sustainability Reporting Directive

Scope: Only companies with more than 1000 employees would be in scope of the CSRD. This further aligns the CSRD’s scope with that of the CSDDD, and removes around 80% of the companies that are currently in scope.

Value chain cap: For companies with less than 1000 employees, the Commission will adopt a voluntary reporting standard, based on the standard for SMEs (VSME). This would also limit the information that companies and banks in scope of the CSRD can request from companies that are not in scope.

European Sustainability Reporting Standards (ESRS): While the current proposal does not entail any changes to the ESRS, the Commission plans to revise the ESRS and reduce the number of data points within 6 months after the entry into force of the Omnibus Package.

Sector-specific Standards: The Omnibus proposal would delete the requirement for the Commission to adopt sector-specific standards.

Taxonomy Regulation Article 8: The proposal aims to make reporting in line with Article 8 of the Taxonomy Regulation voluntary for those companies that are in scope of the CSRD and that have a net turnover of up to 450 million.

Non-EU companies: The thresholds for non-EU companies to be in scope of the CSRD are proposed to be amended by (i) aligning the size threshold of subsidiaries with the the size of EU companies in scope of the CSRD, (ii) increasing the threshold for branches from 40 million Euro to 50 million Euro, (iii) increasing the net turnover threshold for the third-country undertaking from 150 million Euro generated in the Union to 450 million Euro. While the proposal does not imply any changes to the adoption timeline of the ESRS for non-EU groups (NESRS), the expected changes to the ESRS will have a knock-on effect on the content of the NESRS.

Assurance: The Omnibus Package proposes to remove the time limits for the Commission to adopt standards for limited assurance and to delete the empowerment for the Commission to adopt standards for reasonable assurance.

For a quick overview of the proposed changes, please consult the table below:

| Requirement Type/ Criteria | Current requirement | Proposed Changes |

| Reporting deadlines for wave 2 and 3 companies | First reports due in 2026 and 2027 | Postponed by 2 years (‘stop-the-clock’) |

| Companies in scope | Large public companies, large non-public companies, listed SMEs | Only companies > 1000 employees |

| Value chain reporting | Comprehensive requirements to gather data from upstream and downstream suppliers, within the limits of the ESRS | Information that can be requested from entities in the supply chain with up to 1,000 employees is limited by the content of the VSME |

| ESRS set 1 | Adopted in Regulation 2023/2772 | COM plans to reduce data points within 6 months from the EIF of the Omnibus Package |

| Sector-specific standards | COM to adopt sector-specific standards by 30 June 2026 | No sector-specific standards |

| Taxonomy Article 8 reporting | All EU entities in scope of the CSRD are also required to report in accordance with the EU Taxonomy Regulation | Only companies in scope of the CSRD with a net turnover of up to 450 million are required to report in accordance with the EU Taxonomy Regulation |

| Third-country undertaking thresholds | Third-country undertaking: EUR 150m net turnover in the EU EU branch: EUR 40m net turnover | Third-country undertaking: EUR 450m net turnover in the EU EU branch: EUR 50m net turnover |

| Assurance | COM to adopt limited assurance standard by 1 October 2026 and conduct feasibility assessment for reasonable assurance by 2028 | Time limit for adoption of limited assurance standard removed; no reasonable assurance |

2. Corporate Sustainability Due Diligence Directive

Focus on direct suppliers and business relationships: Under the proposed amendment, companies would only be required to conduct full due diligence with regard to their own operations and direct business partners. Due diligence in the value chain beyond direct business partners would only be required in cases where the company has plausible information suggesting that adverse impacts have arisen or may arise. This proposal has been widely criticized, considering that most of the adverse impact occurs beyond tier 1 of the supply chain.

Updates to due diligence system: The intervals between two regular periodic assessments of the due diligence system is proposed to be increased from one to five years. Companies are however required to assess their due diligence practices more often, if there are reasonable grounds to believe that the measures are no longer adequate or effective.

Termination of business relationships: The proposal aims to remove the duty to terminate the business relationship as a measure of last resort.

Reduction of the trickle-down effect: Companies in scope may only require the type of information from their SME and small midcap business partners that is specified in the CSRD voluntary reporting standard, except when additional data is essential for supply chain mapping and unavailable elsewhere.

Climate Transition Plan: While the Climate Transition Plan remains mandatory, the proposed change from ‘adopt and put into effect’ to simply ‘adopt’ removes the requirement to track its effectiveness, which has the potential to significantly weaken the plan’s purpose.

Civil Liability: The proposed amendments will no longer mandate civil liability at the member state level, though states may choose to enact it in national law. Furthermore, the provisions enabling NGO representative actions are set to be removed.

Fining guidelines: The Commission will be tasked with the development of guidelines for fines imposed by Member States. At the same time, the “minimum cap” for fines is removed, meaning that Member States are no longer required to impose fines that are not less than 5% of the net worldwide turnover of the company. Civil society organizations fear this will trigger a ‘race to the bottom’ and encourage so-called ‘forum shopping’.

For a quick overview of the proposed changes, please consult the table below:

| Requirement Type/ Criteria | Current requirement | Proposed changes |

| Value chain due diligence obligations | Own operations, business partners and value chain | Limited to own operations and direct business partners and suppliers; value chain due diligence only necessary where there is evidence for adverse impact |

| Termination of business relationships | Must be taken as a last resort measure, if mitigation or suspension don’t work | Removing the obligation to terminate business relationships even if all other measures fail |

| Climate Transition Plan | ‘Adopt and put into effect’ | ‘Adopt’ |

| Civil Liability | MS obliged to introduce civil liability and enable representative action by NGOs and trade unions | Introduction of civil liability no longer mandatory for MS; no representative action |

| Administrative Fines | To be determined in national law; “minimum cap” of 5% of the net worldwide turnover of the company as the lowest possible upper limit for MS penalties | To be determined in national law, no “minimum cap”. COM to publish fining guidelines for MS. |

Will Double Materiality be Affected?

Contrary to widespread rumors in the run-up to the Omnibus publication, there are no changes to the double-materiality principle. ‘Double-materiality’ is one of the fundamental concepts of the CSRD, requiring companies to take both financial and impact materiality into account in their reports, and provide information on the impact of sustainability on their financial risks and opportunities as well as information on their own impact on people and the environment.

What is Proposed for the Taxonomy Regulation and CBAM?

In addition to the already discussed changes to the thresholds for companies that are obliged to report information in line with Article 8 of the Taxonomy Regulation, the Omnibus Package contains further proposed amendments to the Taxonomy Implementing Acts (Regulation (EU) 2021/2178, Regulation (EU) 2021/2139 and Regulation (EU) 2023/2486).

Amongst the most important changes is the proposal to allow undertakings to omit information on activities below a 10% financial materiality threshold. A 25% threshold applies for non-financial undertakings regarding operational expenditure. In addition, the proposal contains changes to the ‘Do no significant harm’ criteria particularly for pollution prevention & control. Interestingly, this is the only part of the Omnibus Package that is subject to a public consultation. Comments can be submitted until 26 March 2025.

Proposed changes to the Carbon Border Adjustment Mechanism (CBAM) concern exempting small importers from the requirements and simplifying the calculation and reporting rules. Further changes to the scope of CBAM are intended to be published in a separate proposal in early 2026.

What’s Next?

The Omnibus Package has faced widespread criticism from both civil society and businesses. While businesses are worried about the uncertainty that is created particularly by the ‘stop-the-clock’ proposal, civil society groups have expressed concerns that the Omnibus Proposal significantly weakens key EU sustainability regulations by shrinking the scope of the CSRD by nearly 80%, removing substantial value chain due diligence obligations under the CSDDD, and diluting the Climate Transition Plan requirements.

It is however important to remember that the package is still in its draft form and changes are expected throughout the legislative process. The EU Parliament and EU Council are now required to adopt their own positions, and while the Council, who already signaled its agreement in advance of the publication, will likely come to a swift agreement, extensive discussions are expected to take place in the Parliament over the coming months.

Stay Ahead Of Regulatory Changes like the EU’s Omnibus Package

Want to stay ahead of these regulatory developments?

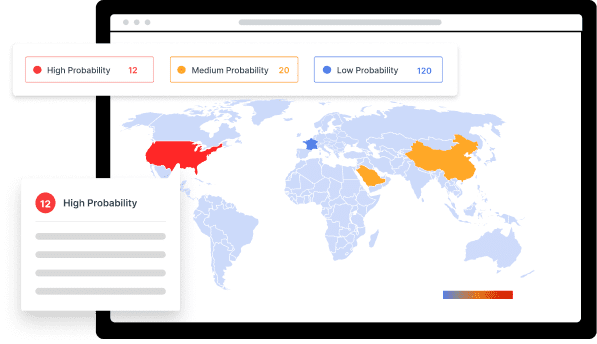

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Authors

Hannah Janknecht,

Regulatory Compliance Specialist

Hannah joined the Global Regulatory Compliance team in Compliance & Risks as a Regulatory Specialist in September 2022. She is responsible for the monitoring of regulatory developments in German-speaking countries and helps clients with questions on Textiles, ESG Reporting, Illegal Logging and Supply Chain Due Diligence. Hannah studied law in Germany (University of Bonn) and holds an LL.M. in Environmental and Natural Resources Law from University College Cork. Prior to joining Compliance and Risks, Hannah worked for various government agencies in Germany, mainly in the area of the Common Agricultural Policy.