Regulatory Trends in ESG: A 12-18 Month Outlook

A 12-18 month outlook for regulatory trends in ESG

In today’s world it is no longer sufficient to simply claim your company embraces environmental, social and governance considerations. More and more such statements are being put under the microscope from investors to customers to employees who want to know how ESG conscious a company really is.

Additionally, we are witnessing an unfolding global trend to make ESG reporting mandatory with legislation cropping up in the EU, UK, USA and further afield. This is in response to concerns that sustainability reporting throws up in relation to the quality, reliability, comprehensively and comparability of the information being reported on and the knock-on effects this may have in terms of directing finance towards greener and more sustainable investments.

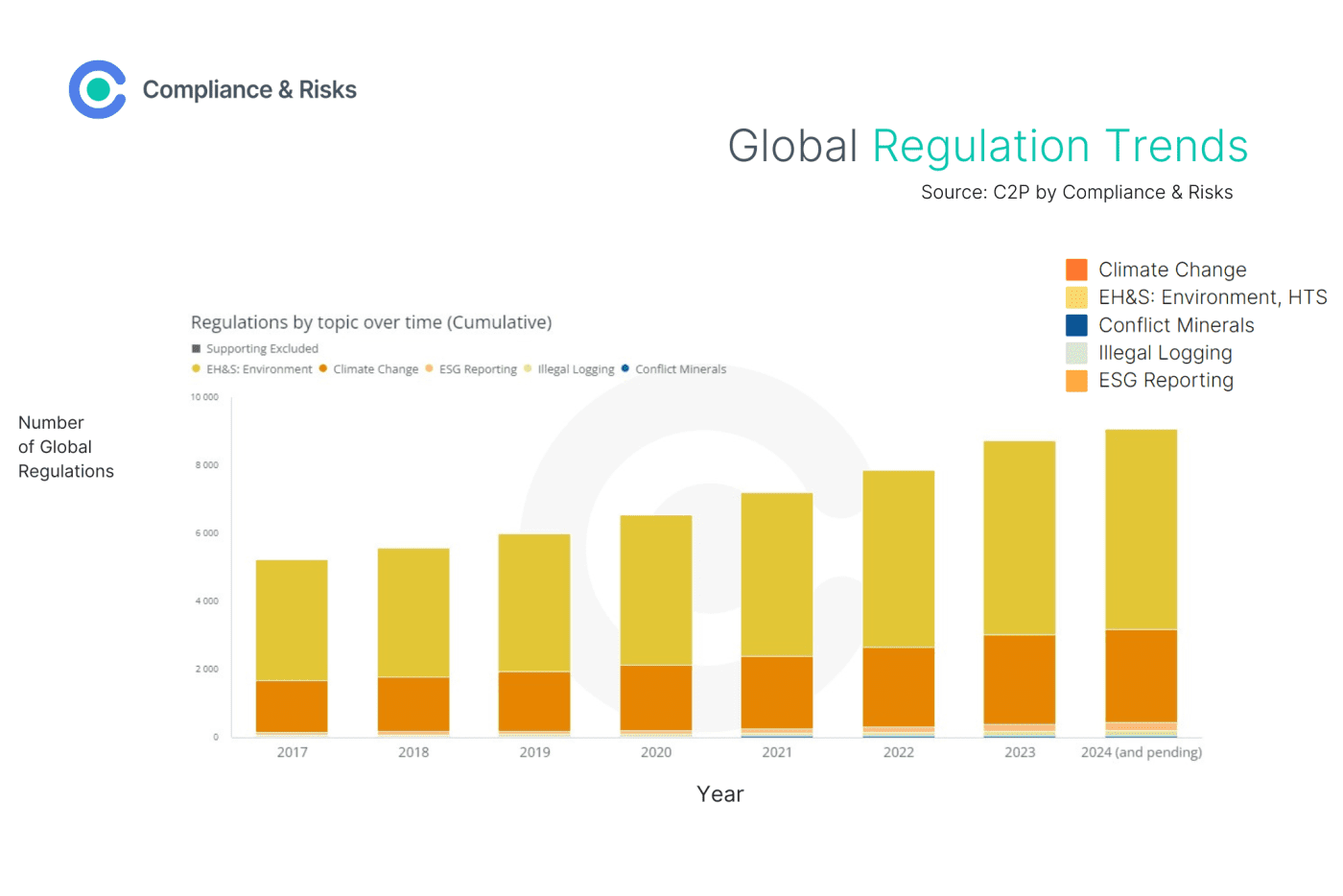

(Source: C2P by Compliance & Risks)

Figure 1 above shows the growth in ESG reporting regulations, as well as other ESG type regulations in areas such as climate change, illegal logging, human trafficking & slavery and conflict minerals. The volume of just ESG reporting regulations has grown from 23 regulations in 2021 to 150 regulations in 2023 – a 552% increase!

Hot Topics

Here’s a bird’s-eye view of the regulatory topics you need to be aware of to stay on top of your ESG objectives.

Sustainable Products In The Limelight

Never before has the need to protect our environment been more to the forefront of the world’s consciousness. Regulators are fast responding enacting measures focused on minimising the environmental impacts of products.

The net result is even more regulation to contend with.

As recently noted by the EU Commission “Products use up massive amounts of materials, energy and other resources and cause significant environmental impacts throughout their lifecycle, from the extraction of raw materials, to manufacture, transport, use and end of life. Half of global greenhouse gases and 90% of biodiversity loss are caused by extracting and processing primary raw materials.”

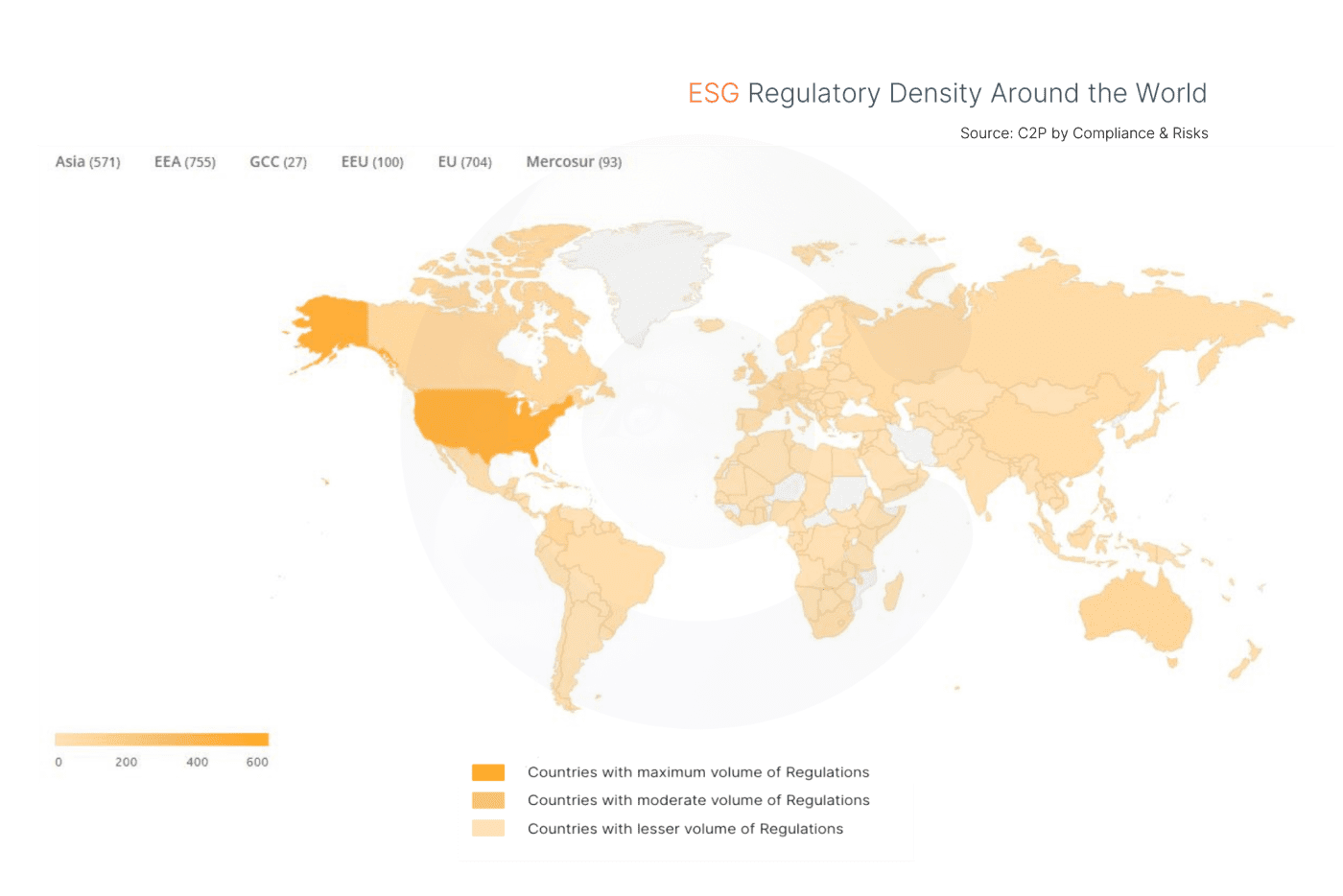

(Source: C2P by Compliance & Risks)

Top Trending Regulations

Listed below are the key regulations that will be impacting your business over the next 12-18 months:

- EU: Corporate Sustainability Reporting, Directive 2022/2464

- EU: Sustainability Reporting Standards, Commission Delegated Regulation 2023/2772

- Latvia: Sustainability Disclosure, Draft Law, January 2024

- UK: Sustainability Reporting Standards, Guidance Document, Revised, May 2024

- UK: Non-financial Reporting Review: Simpler Corporate Reporting, Consultation Document, May 2024

- Canada: Sustainability Disclosure Standard CSDS 1 – General Requirements for Disclosure of Sustainability-related Financial Information, Exposure Draft Standard, March 2024

- USA: Enhancement and Standardization of Climate-Related Disclosures for Investors, Final Rule, 89 FR 21668, March 2024

- Arizona (USA): Forced Labor and Oppressive Child Labor, House Bill 2591, January 2024

- Washington (USA): Fashion Retailer and Manufacturer ESG Reporting, Senate Bill 5965, January 2024

- Singapore: Sustainability Reporting: Enhancing Consistency and Comparability, Consultation Document, March 2024

- China: Sustainability Reporting for Major Listed Companies, Guidelines, April 2024

- South Korea: Sustainability Disclosure Standards, Draft Standard, April 2024

Stay Ahead Of ESG Regulatory Changes And Trends?

Want to stay ahead of regulatory developments in esg?

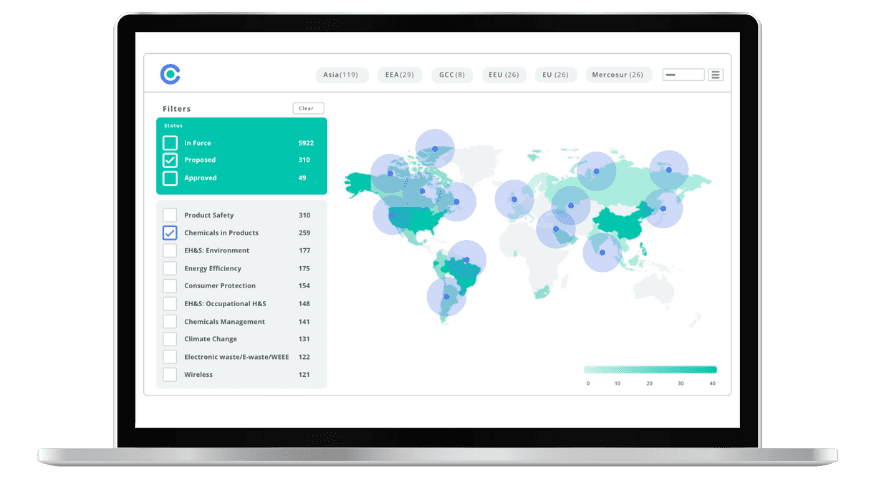

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – Your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Stay On Top Of Your Changing Regulatory Obligations

Tell us your compliance challenges and we will find the solution that’s right for you.