RoHS, Monitoring and Control Instruments, Category 11 and the 21 July 2024 Deadline

This blog was originally posted on 24th April, 2024. Further regulatory developments may have occurred after publication. To keep up-to-date with the latest compliance news, sign up to our newsletter.

AUTHORED BY JOYCE COSTELLO, SENIOR REGULATORY COMPLIANCE SPECIALIST, COMPLIANCE & RISKS

RoHS exemptions – introduction

Most companies who need to ensure their products comply with EU RoHS will be familiar with longstanding weaknesses in the exemption procedure, particularly as regards the duration of the exemption process (evaluation of exemptions and related decision-making currently takes more than 24 months, and more than 60 exemption requests were pending as of December 2022), and the uncertainty engendered by persistent delays in decision-making in the Commission.

As of today some 24 exemptions, some very widely used within industry, are awaiting decision by the Commission as to their fate.

Bio Innovation Service ran a consultation from 16 October until 11 December 2023 regarding Pack 27. Many exemptions included in Pack 27 were already reviewed in 2021 and 2022. The objective of the Pack 27 exemption review round was to assess whether any substantial reasons in line with Art. 5(1)(a) could be found against the adoption of the recommendations from the previous reviews to be applied to EEE of categories 8, 9 and 11. The Commission website states, in respect of Pack 22 (status February 2024) In order to reach a final decision on the Pack 22 exemption requests, the assessments under the Pack 27 need to be completed since applications are partly covered for the same exemption entries. The Commission will then draw up draft acts, which will be also subject to a public consultation.

In practice, what will happen on 21 July 2024?

From 21 July 2024, products which had benefited from the exemption will no longer be permitted to be placed on the market, if they do not comply with the substance restrictions. In other words, they cannot be made available for the first time – including supplied for distribution, consumption or use on the Union market in the course of a commercial activity, whether in return for payment or free of charge.

So if equipment was already placed on the market before 21 July 2024, it can remain on the market. This is reflected in Article 4(4)(f) of Directive 2011/65/EU which provides that EEE which benefited from an exemption and which was placed on the market before that exemption expired, as far as that specific exemption is concerned, is exempt from the Article 4(1) restriction.

Parties currently using any of these exemptions are entitled to continue to depend upon them for compliance, even beyond the ‘deadline’ of 21 July 2024. This is clear from the Directive, which states that an existing exemption will remain valid until a decision on the renewal application is taken by the Commission.

The question nonetheless remains when the Commission will take decisions, are what are the potential scenarios.

Scenario No. 1

Decision: The Commission decides that it can no longer justify the exemption, and therefore rejects the application to renew it.

Outcome: Commission will adopt a delegated acts (amending the RoHS directive).

Implication: The exemption can continue to be used for at least another 12 months, and at the most 18 months, after the date of the decision. So, if any of the below-listed exemptions are revoked by the Commission, companies will be looking at a transition of 12-18 months to adjust their manufacturing to the new situation. Critically, EEE which was already placed on the market before the exemption expired (as far as that specific exemption is concerned) can remain on the market.

Scenario No. 2

Decision: The Commission decides that the conditions for renewal of the exemption per Article 5(1)(a) have been fulfilled.

Outcome: Commission will adopt a delegated acts (amending the RoHS directive).

Implication: Exemption can continue to be used for newly-defined expiry period (note that exemption may be reframed).

Which RoHS exemptions will the EU Commission decide on first?

As of 22 April 2024, the EU Commission is preparing draft amending legislation with regard to Exemptions 6 (a), (b) and (c), Exemption 7(a), Exemption 7(c)-I and 7(c)-II, and plans to adopt the acts in Q3, 2024. The Commission operates a policy of giving priority to older applications.

RoHS exemptions for which applications for renewal were made in due time, and which remain valid beyond 21 July 2024

6(a) Lead as an alloying element in steel for machining purposes and in galvanized steel containing up to 0,35 % lead by weight for category 9 industrial monitoring and control instruments, and for category 11

Pack 22 and Pack 27 (Part I)

6(b) Lead as an alloying element in aluminum containing up to 0,4 % lead by weight for category 9 industrial monitoring and control instruments, and for category 11

Pack 22 and Pack 27 (Part I)

6(c) Copper alloy containing up to 4 % lead by weight for category 9 industrial monitoring and control instruments, and for category 11

Pack 22

7(a) Lead in high melting temperature type solders (i.e. lead-based alloys containing 85 % by weight or more lead) for category 9 industrial monitoring and control instruments, and for category 11

Pack 22 and Pack 27 (Part I)

7(c)-I Electrical and electronic components containing lead in a glass or ceramic other than dielectric ceramic in capacitors, e.g. piezoelectronic devices, or in a glass or ceramic matrix compound for category 9 industrial monitoring and control instruments, and for category 11

Pack 22 and Pack 27 (Part I)

7(c)-II Lead in dielectric ceramic in capacitors for a rated voltage of 125 V AC or 250 V DC or higher for category 9 industrial monitoring and control instruments, and for category 11

Pack 22

8(b) Cadmium and its compounds in electrical contacts for category 9 industrial monitoring and control instruments, and for category 11

Pack 23 and Pack 27 (Part II)

13(a) Lead in white glasses used for optical applications for category 9 industrial monitoring and control instruments and for category 11

Pack 27 (Part II)

13(b) Cadmium and lead in filter glasses and glasses used for reflectance standards for category 9 industrial monitoring and control instruments and for category 11

Pack 27 (Part II)

15 Lead in solders to complete a viable electrical connection between semiconductor die and carrier within integrated circuit flip chip packages for category 9 industrial monitoring and control instruments, and for category 11

Pack 27 (Part I)

18(b) Lead as activator in the fluorescent powder (1 % lead by weight or less) of discharge lamps when used as sun tanning lamps containing phosphors such as BSP (BaSi2O5:Pb) for category 9 industrial monitoring and control instruments, and for category 11

Pack 27 (Part I)

24 Lead in solders for the soldering to machined through hole discoidal and planar array ceramic multilayer capacitors for category 9 industrial monitoring and control instruments

Pack 24

29 Lead bound in crystal glass as defined in Annex I (Categories 1, 2, 3 and 4) of Council Directive 69/493/EEC for category 11

Pack 24

32 Lead oxide in seal frit used for making window assemblies for Argon and Krypton laser tubes for category 9 industrial monitoring and control instruments

Pack 24

34 Lead in cermet-based trimmer potentiometer elements for category 9 industrial monitoring and control instruments, and for category 11

Pack 24 and Pack 27 (Part II)

42 Lead in bearings and bushes applied in certain non-road professional use equipment for category 11

Pack 27 (Part II)

44 Lead in solders used in certain combustion engines for category 11

Pack 27 (Part II)

RoHS exemptions for which applications for renewal were not made in due time, and which will expire on 21 July 2024

7(c)-IV Lead in PZT based dielectric ceramic materials for capacitors which are part of integrated circuits or discrete semiconductors for category 9 industrial monitoring and control instruments, and for category 11

No longer renewable: expires 21 July 2024

9 Hexavalent chromium as an anticorrosion agent of the carbon steel cooling system in absorption refrigerators up to 0,75 % by weight in the cooling solution for category 9 industrial monitoring and control instruments, and for category 11

No longer renewable: expires 21 July 2024

9(b) Lead in bearing shells and bushes for refrigerant-containing compressors for heating, ventilation, air conditioning and refrigeration (HVACR) applications for category 9 industrial monitoring and control instruments and for category 11

No longer renewable: expires 21 July 2024

24 Lead in solders for the soldering to machined through hole discoidal and planar array ceramic multilayer capacitors for category 11

No longer renewable: expires 21 July 2024

29 Lead bound in crystal glass as defined in Annex I (Categories 1, 2, 3 and 4) of Council Directive 69/493/EEC for category 9 industrial monitoring and control instruments

No longer renewable: expires 21 July 2024

32 Lead oxide in seal frit used for making window assemblies for Argon and Krypton laser tubes for category 11

No longer renewable: expires 21 July 2024

37 Lead in the plating layer of high voltage diodes on the basis of a zinc borate glass body 21 July 2024 for category 9 industrial monitoring and control instruments, and for category 11

No longer renewable: expires 21 July 2024

41 Lead in solders and termination finishes of electrical and electronic components and finishes of printed circuit boards used in ignition modules and other electrical and electronic engine control systems, which for technical reasons must be mounted directly on or in the crankcase or cylinder of hand-held combustion engines (classes SH:1, SH:2, SH:3 of Directive 97/68/EC for category 9 industrial monitoring and control instruments

No longer renewable: expires 21 July 2024

43 Bis(2-ethylhexyl) phthalate (DEHP) in certain rubber components used in engine systems for category 11

No longer renewable: expires 21 July 2024

Stay Ahead Of RoHS Regulatory Changes

Want to stay ahead of RoHS regulatory developments?

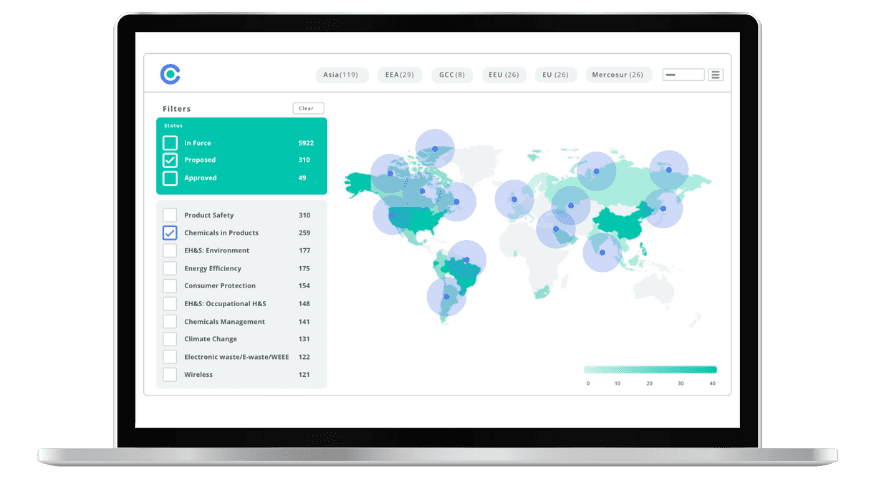

Accelerate your ability to achieve, maintain & expand market access for all products in global markets with C2P – Your key to unlocking market access, trusted by more than 300 of the world’s leading brands.

C2P is an enterprise SaaS platform providing everything you need in one place to achieve your business objectives by proving compliance in over 195 countries.

C2P is purpose-built to be tailored to your specific needs with comprehensive capabilities that enable enterprise-wide management of regulations, standards, requirements and evidence.

Add-on packages help accelerate market access through use-case-specific solutions, global regulatory content, a global team of subject matter experts and professional services.

- Accelerate time-to-market for products

- Reduce non-compliance risks that impact your ability to meet business goals and cause reputational damage

- Enable business continuity by digitizing your compliance process and building corporate memory

- Improve efficiency and enable your team to focus on business critical initiatives rather than manual tasks

- Save time with access to Compliance & Risks’ extensive Knowledge Partner network

Chemicals Quarterly – Q1 Regulatory Update 2024

An overview of the latest news on permitted, restricted and prohibited substances in a variety of products from around the world.