Shifting Sands: Emergence of ESG as a Global Hot Issue

Spotlight on ESG with Greenwashing Headlines

ESG is the ‘it’ word in 2023 as a result of recent greenwashing controversies (read more on how to avoid it in our guide) and political challenges at the top of headlines. Mandatory and voluntary reporting of climate disclosures is on the rise, with considerable implications for firms and their roadmaps for best practices.

It would not be an exaggeration to state that businesses across the globe are rushing to draft contingency plans to ensure they can meet the numerous mandatory reporting deadlines.

In this blog, we want to help you understand the global context around ESG & sustainability and how it has undeniably emerged to become a global hot topic.

Where it all started..

In 2015 world leaders reached a global breakthrough by signing the Paris Agreement with a simple goal: Make a 50% cut to global emissions by 2030 to stay below 1.5°C of Global Warming. In that same year, the UN introduced 17 Sustainable Development Goals offering the building blocks for policymakers, regulators, banks, and investors to understand the symbiosis between the planet, economic activity, and economic development.

There is nothing idealistic about 193 nations coming together to sign the ambitious target set in the Paris Agreement; this is pure pragmatism based on necessity. The UN’s aim is clear – We must act using this unified framework to create a better and more sustainable future for all.

That is why governments across the globe are introducing new regulations, guidelines, and protocols to ensure that everyone, including banks and businesses, is not only aware of the necessity to reduce global emissions but also understands what they must do to support global efforts.

Persisting Multi-fold Pressures

Looming deadlines from the regulators

Five years ago, sustainability reporting was in a steady state with most efforts being ‘good to do’. Reports using voluntary frameworks such as the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB) as well as questionnaires from organizations such as the Carbon Disclosure Project (CDP) were the usual types of reports that sustainability managers worked on. Firms producing sustainability reports rarely invested in any kind of assurance.

Fast forward to 2023 and this light-touch approach to sustainability data management and reporting is increasingly untenable. The EU has imposed mandatory climate and ESG disclosure rules from January 5th, 2023. These regulatory developments reflect macro trends in the natural environment and across societies, making any reversal of these developments highly unlikely.

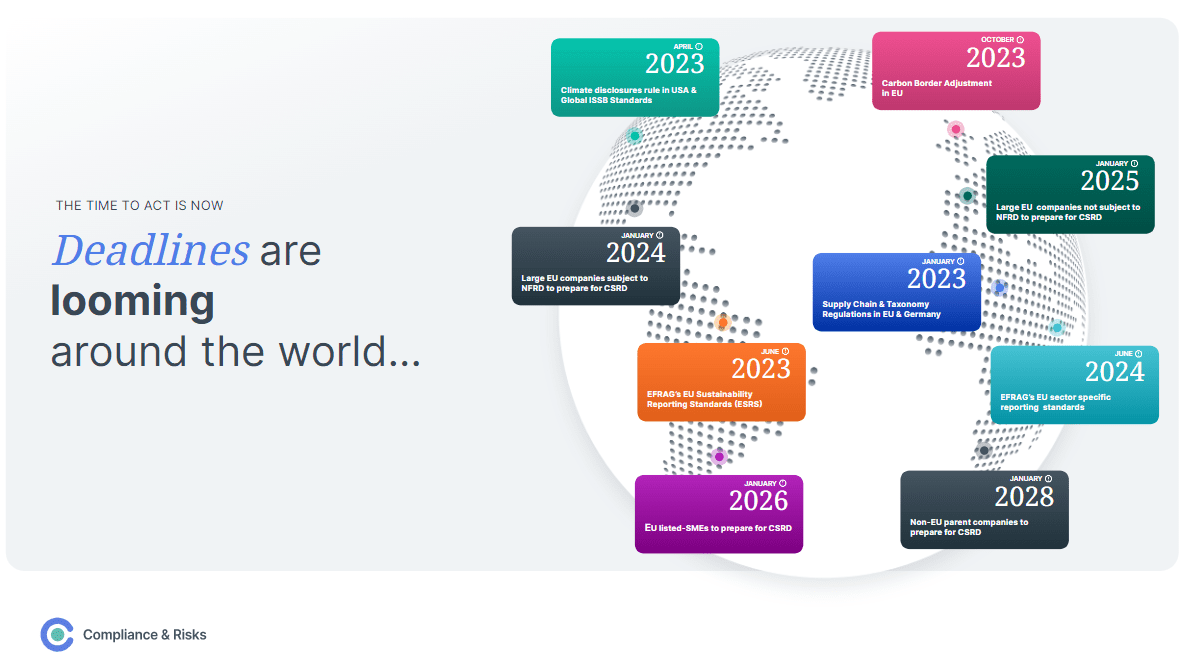

The upcoming dates (See image 1 below) are only the beginning of what is predicted to be a long series of looming deadlines steadily implemented across the world.

Image 1: Looming global ESG deadlines. Source: C2P Platform by Compliance & Risks

Growing Sustainability Concerns for Product Manufacturers…

“Products use up massive amounts of materials, energy and other resources and cause significant environmental impacts throughout their lifecycle, from the extraction of raw materials, to manufacture, transport, use and end of life. Half of the global greenhouse gasses and 90% of biodiversity loss are caused by extracting and processing primary raw materials. Negative environmental impacts include significant resource depletion, generation of greenhouse gas emissions, and pollution. ”

EU Commission, March 2022 in Q&A on the Sustainable Products Initiative

Investors are finding a shortage of ESG investment opportunities

As reported by the New York Times, assets in ESG funds have risen by 38% in the past year. ESG-focused institutional investment is predicted to soar 84% to US $33.9 trillion in 2026, making up 21.5% of assets under management. It represents a dramatic and continuing shift in the asset and wealth management (AWM) industry according to PwC’s Asset and Wealth Management Revolution 2022 report.

While more and more investors are looking for ESG initiatives to invest in, there is a shortage of ESG investment opportunities with $1trillion+ into ESG investment funds in the past 2 years (Source: Best Execution) – such is the demand and interest within the ESG realm. ESG-mandated assets are projected to make up half of all professionally managed assets globally by 2024. (See Image 2 below).

Image 2: ESG-mandated assets market overview and growing investor focus on ESG

Source: Deloitte Insights

Sustainability has thus escalated to become a board-level priority since companies want to attract investors for obvious reasons. Companies operating with a true long-term mindset made critical decisions like investing more in R&D and, as a result, had 47% higher revenue growth & faster-growing market caps. Better tools and thinking can lead to more and better action. (Source: A study from McKinsey & FCLTGlobal)

Consumer behaviour is embracing sustainability

Consumers care about sustainability—and are backing it up with their wallets. Consumer trends in 2023 suggest that concerned consumers are adopting a raft of different measures to shop and live more sustainably.

- 60% of consumers are willing to change their shopping habits to reduce environmental impact. 80% indicate that sustainability is important for them. For those who say it is very/extremely important, over 70% would pay an average premium of 35% for brands that are sustainable and environmentally responsible. (Source: IBM)

- 48% of consumers want companies to show more progress on social issues (e.g. D&I and data security and privacy). (Source: PwC)

- 53% of Gen Z participants expect brands to have diverse senior leadership and 47% expect companies to donate to organizations promoting Diversity & Inclusion. (Source: Quantilope)

- 70% of consumers consider company values in their purchasing decision-making. 60% are inclined to buy products from consumer goods companies that provide transparency around the origins and supply chains of their products. (Source: Consultancy-me)

To conclude…

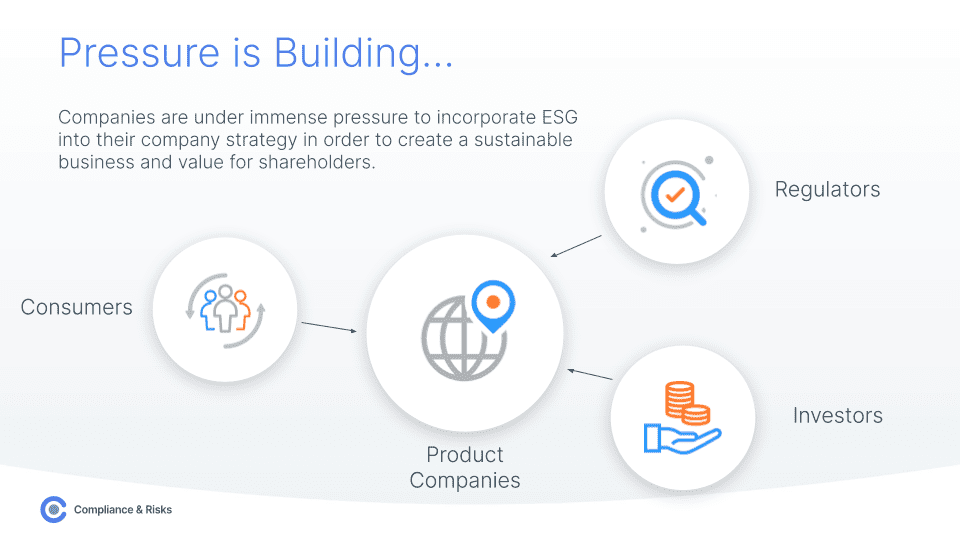

Product manufacturers are under increasing pressure due to a shift in behaviours by investors, customers and regulators all of which have driven the increase in mandatory reporting measures in alignment with macro ESG trends globally. (See Image 3 below)

Image 3: Multifold pressures in play for Product companies to implement ESG strategies.

Source: Compliance & Risks

A shift from Voluntary to Mandatory Disclosures – Impact on global organizations

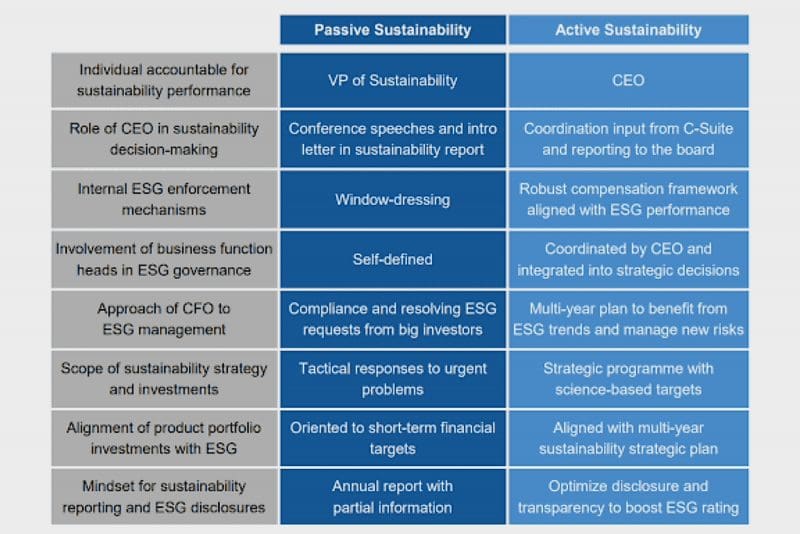

Image 4: Comparison of Passive & Active Sustainability Strategies.

Source: Verdantix, Investor Focus On ESG Will Transform Sustainability Strategies, Feb 2021

A key ESG development between the 2010s and the 2020s is the need for mandatory climate disclosures. Voluntary sustainability reporting runs parallel with this, partly because of increasing ESG controversies. CEOs are no longer ignoring the demands of investors and stakeholders on ESG issues. Instead, they are transitioning sustainability strategy development from a passive to an active status, reflecting macro ESG trends.

Verdantix, Investor Focus On ESG Will Transform Sustainability Strategies, Feb 2021

All the detailed developments have basically pushed ESG to become a strategic importance for global organizations.(See Image 4 above) Companies need to formulate their overarching ESG strategy to align with their business strategy and take the next steps from there.

ESG compliance is now very much a mandatory legal requirement with the move from voluntary to mandatory sustainability reporting across the globe.

In the EU, for example, the CRSD requires mandatory sustainability reporting for companies in scope pursuant to EFRAG’s ESRS standards. The UK has also followed this trend with the Companies Strategic Report (Climate-related Financial Disclosure) Regulations which made sustainability reporting in accordance with the Taskforce for Climate-Related Financial Disclosure (TCFD) compulsory for a number of UK companies. Mandatory Climate Reporting Obligations also apply to large Swiss companies as of 1 January 2024.

Mandatory ESG reporting currently only really applies to companies above a certain threshold e.g., revenue and/or number of employees.

For example, the CRSD applies to:

- All companies listed on EU-regulated markets;

- “Large” unlisted EU companies not listed i.e., companies exceeding at least two of the following on two consecutive annual balance sheet dates:

-€20 million total assets

-€40 million net turnover (revenue)

-250 employees during fiscal year:

- EU companies that are a parent of a “large group” i.e., a group consisting of parent and subsidiary entities and which, on a consolidated basis, exceeds at least two of the metrics outlined above.

Publicly traded companies: ESG reporting is becoming increasingly common for publicly traded companies, as investors and the public are increasingly interested in the ESG performance of companies they invest in or buy goods and services from.

Private companies: CSRD applies to large unlisted EU companies above certain thresholds. It is worth noting that EFRAG is currently reviewing the potential development of a voluntary sustainability reporting standard for non-listed small and medium-sized undertakings that fall outside the scope of the CSRD.

Non-profit organizations: ESG reporting is also becoming increasingly common for non-profit organizations, as they look to demonstrate their impact and build trust with stakeholders.

It is important to note that the requirements for ESG reporting can vary by country, region, and industry, and it is recommended to seek the guidance of a professional to understand the specific reporting requirements for your company.

Implications of Non-Compliance

Non-compliance with the above-discussed ESG mandatory reporting obligations exposes companies to an array of financial and reputational damage risks such as, but not limited to

- Lengthy regulatory investigations, immersed in criminal and civil proceedings or liable for payment of hefty fines.

- Loss in value, investors and market share are increasingly likely.

- Increased brand avoidance following a greenwashing revelation.

The Securities and Exchange Commission (SEC) sued BNY Mellon Investment Adviser, Inc. for misstatements and omissions about ESG considerations with a $1.5 million penalty in May 2022. The CEO of Germany’s largest asset manager DWS resigned following a police raid over greenwashing concerns in June 2022. The Securities and Exchange Commission (SEC) found that Fiat Chrysler Automobiles (FCA) violated the reporting provisions of the federal securities laws, by providing incorrect information about its environmental compliance status with a $9.5 million penalty in September 2020.

ESG Compliance Journey

Implementation of an ESG and sustainability vision for a company is not a one-off activity, but rather a journey with stakeholders from a variety of departments.

Image 5: ESG Reporting Compliance Journey

Here are 9 steps recommended by industry experts, for any organization to accelerate its ESG journey, (See Image 5 above)

- Understand your mandatory obligations With an overwhelming volume of activity within the ESG realm, it is crucial to have a clear focus on the most important legally binding obligations. It is recommended to start with the fastest-approaching deadlines for mandatory obligations that your business would be subject to.

- Set your goals & targets An alignment of organizational priorities and fast-approaching mandatory ESG deadlines would be your company’s ESG strategy. Having multiple goals and targets feeding into each goal is a recommended approach to effectively work towards achieving ESG compliance.

- Collect your data The next step to do after setting goals and targets is to start working on your data infrastructure requirements. This would include listing out the ESG reporting requirements, and various data points needed across different frameworks.

- Align your teams The biggest challenge we have heard from the market is getting alignment across all stakeholder teams, and it’s single-handedly the most important step to ensure there is no ‘Compliance Surprise’ later on.

- Track & report on progress Once there is perfect alignment and teams are collaborating to build a smooth data infrastructure for ESG, the next step is to bring all that data together to be able to track progress towards each ESG goal and targets to be able to build effective ESG reports.

- Report to investors, shareholders, and customers Once all the data points are collected, teams then need to work with the ESG reporting frameworks to report to investors, shareholders and customers as needed.

- Monitor regulatory changes The ESG regulatory landscape is ever-evolving and there are always multiple regulatory updates and more enacted deadlines that a company might be obliged to. It is important to always monitor the regulatory landscape for any updates to ensure you can stay on top of all legal requirements.

- Understand the Impact of changes If there are new regulatory updates, then the relevant sustainability teams need to assess and interpret the regulation and requirements so that the company can successfully oblige to the reporting requirements.

- Adjust goals & targets Any regulatory update that needs to be actioned on will have an impact on the overarching ESG strategy, so it’s important to keep iterating and feeding back to the ESG goals and targets to ensure nothing slips through the cracks.

Talk to us to understand how C2P can help Accelerate your ESG Journey